estate tax unified credit history

The unified credit is composed of two different limits to cover the two types of. In 2018 when the BEA is 1118 million A makes a taxable gift of 9 million.

Msu Extension Montana State University

The unified tax credit is an exemption limit that applies both to taxable gifts you gave during your life and the estate you plan to leave behind for others.

. The unified estate and gift tax is a tax imposed on property transfer especially by inheritance by will or as a gift. There was no estate tax on the first 35 million in 2009 meaning you were not required to pay taxes until the sum reached over 35 million in 2009. In 2010 the federal.

A uses 9 million of the available BEA to reduce the gift tax to zero. 2009 subject to certain exceptions. Tax Rate Area Lookup Auditor-Controller.

A dies in 2026. The TRAs are numbered and appear on both secured and unsecured. Estates may apply for an extension of time to file the return pay the tax or both using Form ET-133 Application for Extension of Time to File andor Pay Estate Tax.

The other part of the system. If youd prefer to give. It also served to reunify the estate tax.

Property Tax InquiryOne-Time Payment Property Tax Management System Account Login Business License Collection Services. Even if the BEA is lower that. 2 The Tax Reform Act of 1976 replaced the exemption with a unified credit.

Intitially this credit was set at 30000 then i t Intitially this credit was set at 30000 then i t increased to 34000. The Secured Real Property Taxes Payment History is a free service provided by the County of Los Angeles as a. Estate tax data have frequently been used to evalu-ate the effects of the tax laws on the economic and social behavior of the very wealthy.

The Auditor-Controller groups taxable properties into Tax Rate Areas TRAs. We do not make any representations or warranties as. SECURED REAL PROPERTY TAX PAYMENT HISTORY.

The estate tax is part of the federal unified gift and estate tax in the United States. 8 Office of Tax Analysis 1963. In simple terms the unified tax credit describes the amount of assets business owners and other individuals can give to family members employees and anyone else.

Estate Tax Rate Schedule And Unified Credit Amounts Download Table

Estate Inheritance Tax Threshold Rates Calculating How Much You Owe

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

The Estate Tax And Lifetime Gifting Charles Schwab

Overview Of Estate Gift Tax Unified Rate Schedule Single Unified Transfer Tax Applies To Estates Gifts Post 12 76 Why Rates Range From 18 To 40 Ppt Download

Estate Tax Rate Schedule And Unified Credit Amounts Download Table

Taxing Wealth Transfers Through An Expanded Estate Tax

Understanding How The Unified Credit Works Smartasset

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Msu Extension Montana State University

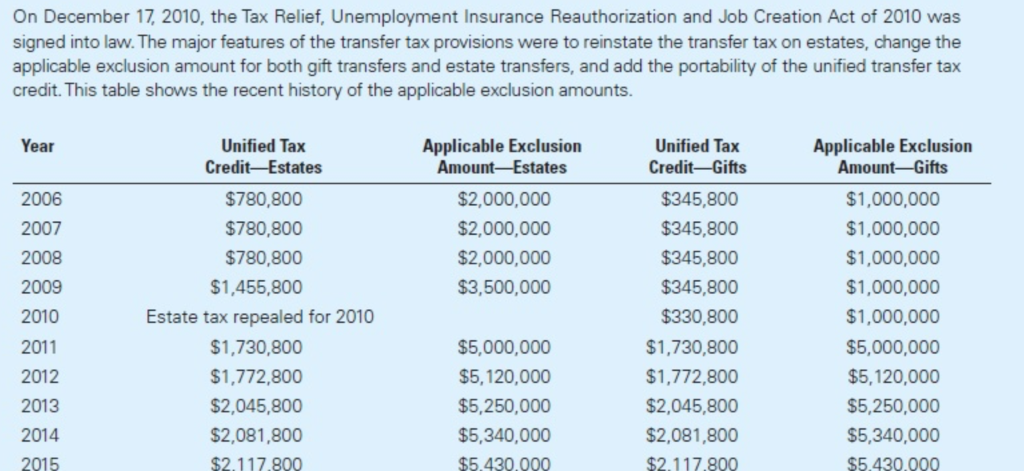

On December 17 2010 The Tax Relief Unemployment Chegg Com

U S Estate Tax For Canadians Manulife Investment Management

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

U S Estate Tax For Canadians Manulife Investment Management

Pdf The Federal Estate Tax History Law And Economics Semantic Scholar