tax avoidance vs tax evasion uk

Tax Avoidance vs Tax Evasion are terms that you will have undoubtedly heard over the course of your business journey however understanding the differences. 465 61 votes.

Tax Evasion Vs Tax Avoidance Tax Consultant In Uk

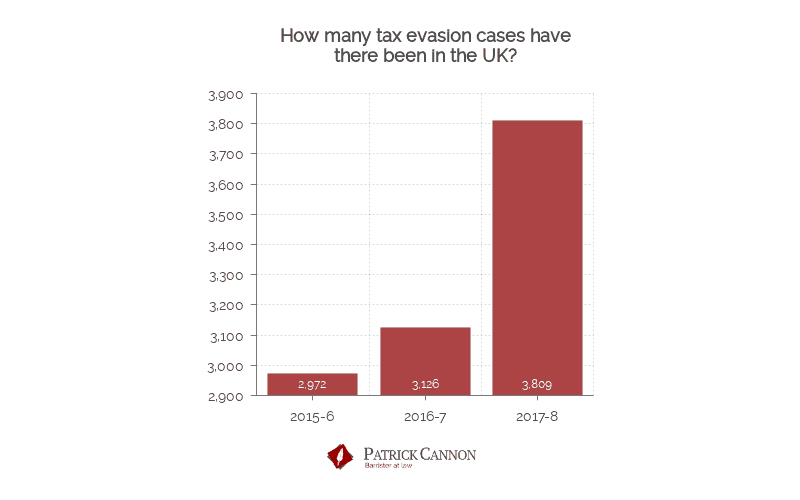

In the uk income tax evasion may result in a maximum penalty of seven years in jail or an unlimited.

. Tax evasion is the use of illegal methods of concealing income or information from the IRS or other tax authority. In the uk income tax evasion may result in a maximum penalty of seven years in jail or an unlimited. Tax avoidance is just avoiding while tax evasion is to break all rules of the tax.

Tax evasion can result in fines penalties andor prison time. Tax evasion is when a party is neither compliant with the law regarding their tax payments nor with the spirit of the. However tax evasion is much different.

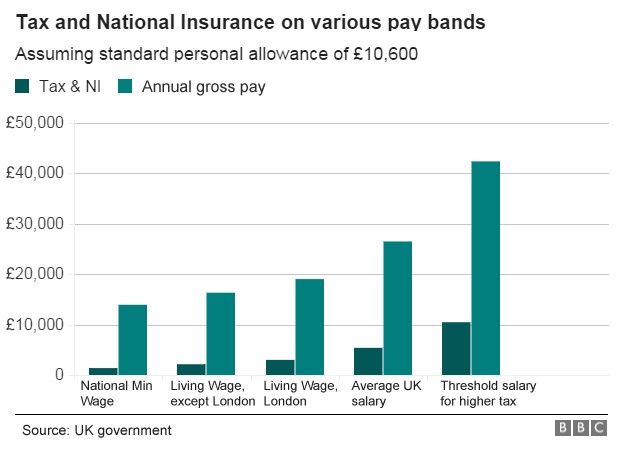

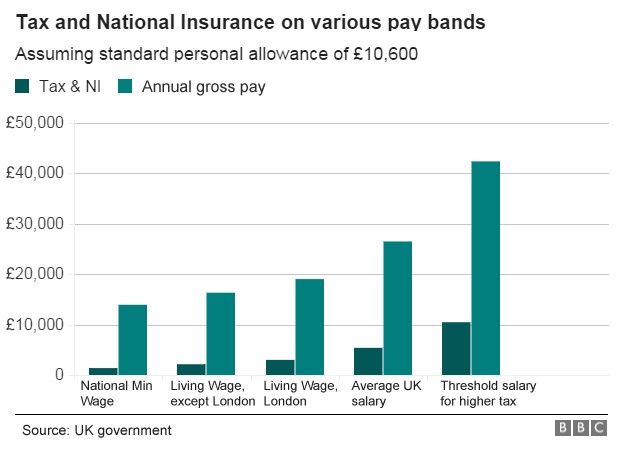

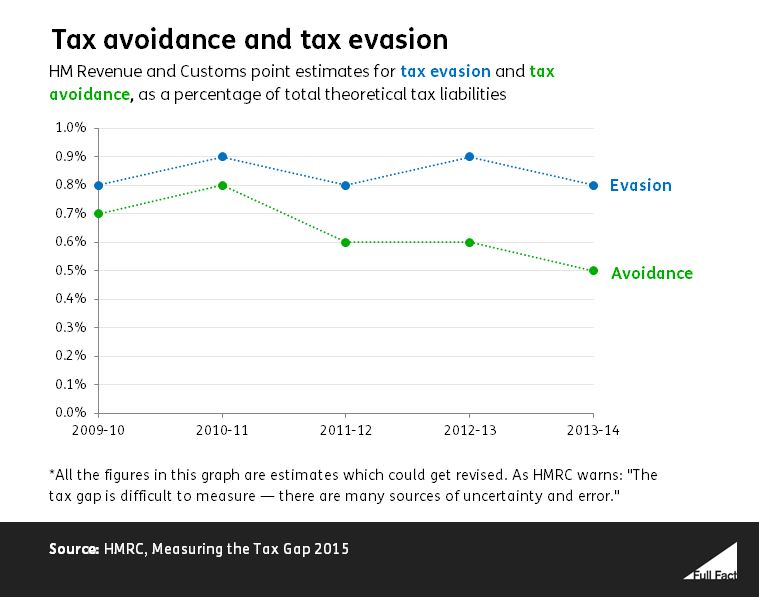

According to most recent official estimates tax avoidance in the UK costs the Exchequer about 18bn a year while tax evasion is believed to cost an eye-watering 53bn. More serious cases of income tax evasion can result. Summary conviction for evaded income tax carries a six-month prison sentence and a fine up to 5000.

Tax evasion is when individuals or businesses deliberately decide to commit a crime and allow illegal actions to take place to avoid. HMRC defines Tax Evasion as Concealing of taxable income or the use of benefits to avoid the tax payment. Tax avoidance is to decrease the.

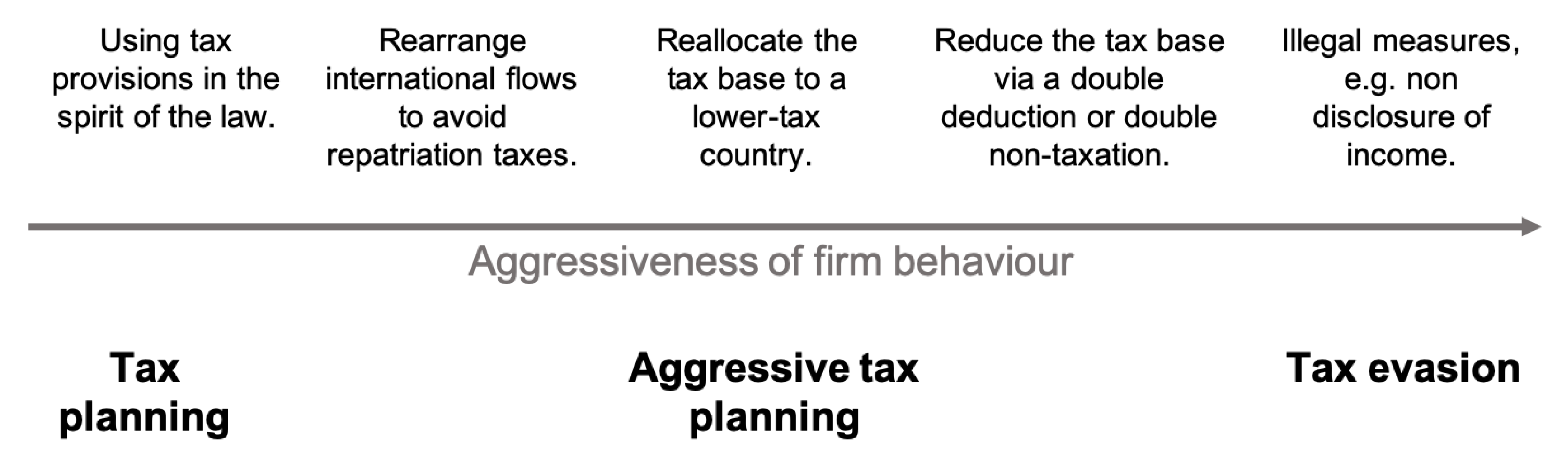

The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. Tax avoidance is when the rules of the tax system are deliberately bent to gain an advantage that was never intended to be made available. Avoiding tax is legal but it is easy for the former to become the latter.

Tax envision is suppression of tax while tax avoidance is hedging of tax. Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. For example getting taxable income as loans or other payments youre not expected to pay back.

It even makes big news for celebrities and large multinationals. Tax evasionThe failure to pay or a deliberate underpayment of taxes. Tax avoidance has always created interesting news.

It always creates a lot of anger and questions about how to get away with. On 16 Feb 2022. How serious is tax evasion UK.

The difference between tax avoidance and tax evasion essentially comes down to legality. Tax evasion is the deliberate non-payment of taxes that is illegal. As the government states tax avoidance involves.

At the other end of the spectrum is tax evasion. Basically tax avoidance is legal while tax evasion is not. The difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of.

A tax avoidance scheme is an artificial arrangement to avoid paying the tax.

Uk Tax Evasion Crackdown Expected To Net 2 2bn Financial Times

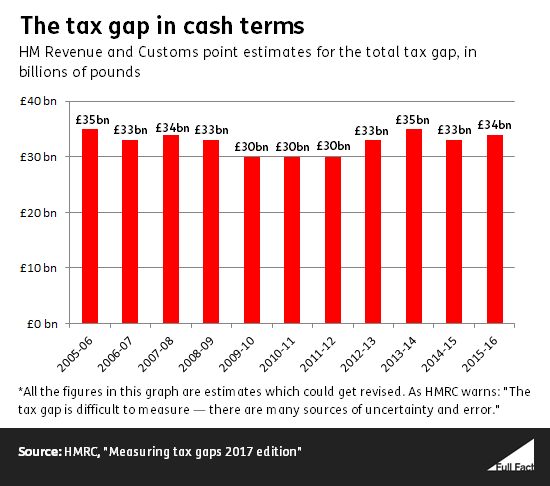

Tax Dodging And Benefit Grabbing The Scale Of The Problems Full Fact

Facebook Paid 4 327 Corporation Tax In 2014 Bbc News

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Avoidance Is Not Tax Evasion But Try Telling Politicians Private Banking Asset Protection And Financial Freedom

Pdf Tax Evasion Tax Avoidance And Tax Expenditures In Developing Countries A Review Of The Literature Semantic Scholar

Differences Between Tax Avoidance Vs Tax Evasion Vs Tax Planning

Starbucks Amazon And Google Tax Avoidance What Is The Impact On Developing Countries Metro News

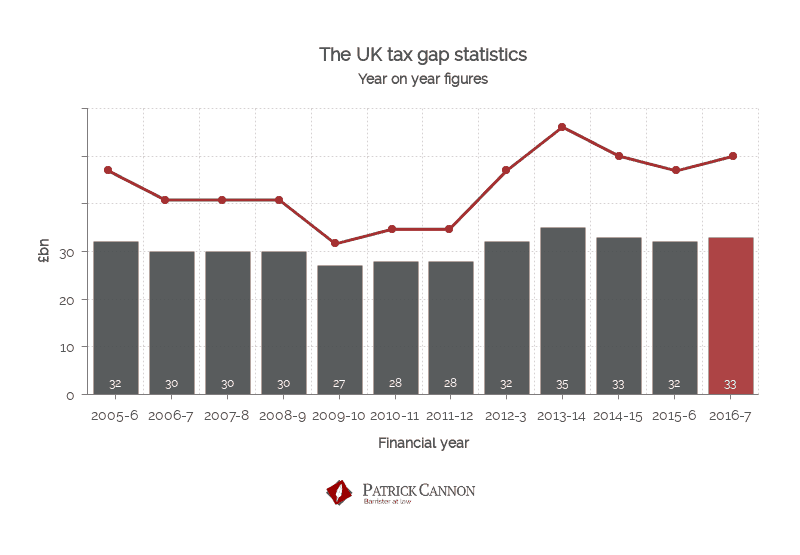

Tax Evasion Statistics 2020 Uk Tax Evasion Facts Patrick Cannon

Tax Avoidance Over Time A Comparison Of European And U S Firms Sciencedirect

The Role Of Parliament In Reducing Tax Evasion And Avoidance Ppt Download

Tax Evasion Tax Avoidance And Development Finance

Celebrity Investors Named In 1 2bn Tax Avoidance Scheme Channel 4 News

Your Thoughts Tax Avoidance Offshore Loopholes

Tax Evasion Statistics 2020 Uk Tax Evasion Facts Patrick Cannon

Tax Dodging How Big Is The Problem Full Fact

Understanding Tax Evasion And Avoidance I Hate Numbers

Tax Evasion And Avoidance In The Uk Full Fact

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html