vermont state tax brackets

There are four tax brackets in Vermont. Box 547 Montpelier VT 05601-0547 Emailtaxbusinessvermontgov Phone.

Vermont Property Tax Rates Nancy Jenkins Real Estate

The 2022 state personal income tax brackets are updated from the Vermont and Tax Foundation data.

. 2020 Vermont Tax Deduction Amounts Tax. These recently reduced rates went into effect in 2018 meaning Vermont taxpayers are able to save more money on. Vermont also has a 600 percent to 85 percent corporate income tax rate.

9 Vermont Meals Rooms Tax Schedule. 335 66 76 and 875. 2021 Vermont Tax Tables.

Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 18 2022. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. Local Option Alcoholic Beverage Tax.

State of Vermont Department of Taxes Taxpayer Services Division PO. TaxTables-2021pdf 22999 KB File Format. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017.

Tax Bracket Tax Rate. 2016 VT Rate Schedules and Tax Tables. Its top rate however is the seventh highest in the country.

Local Option Meals and Rooms Tax. 4 rows Vermont Income Tax Rate 2020 - 2021. Tuesday January 25 2022 - 1200.

The income tax brackets by filing status are as follow. If Taxable Income is. 18 18 18 18.

6 Vermont Sales Tax Schedule. And your filing status is. 5 rows The Vermont income tax has four tax brackets with a maximum marginal income tax of 875.

Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. Vermont Income Taxes. Any sales tax that is collected belongs to the state and does.

Vermont has four marginal tax brackets ranging from 335 the lowest Vermont tax bracket to 875 the highest Vermont tax bracket. At Least But Less Single Married Married Head of. Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets.

Rates range from 335 to 875. 2017-2018 Income Tax Withholding Instructions Tables and Charts. Than filing filing house- jointly sepa- hold rately.

The Vermont Department of Revenue is responsible for publishing the latest Vermont State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of Vermont. 2017-2018 Income Tax Withholding Instructions Tables and Charts.

Vermont state income tax rate table for the 2020 - 2021. Like many other states Vermonts state income tax is progressive. Then your VT Tax is.

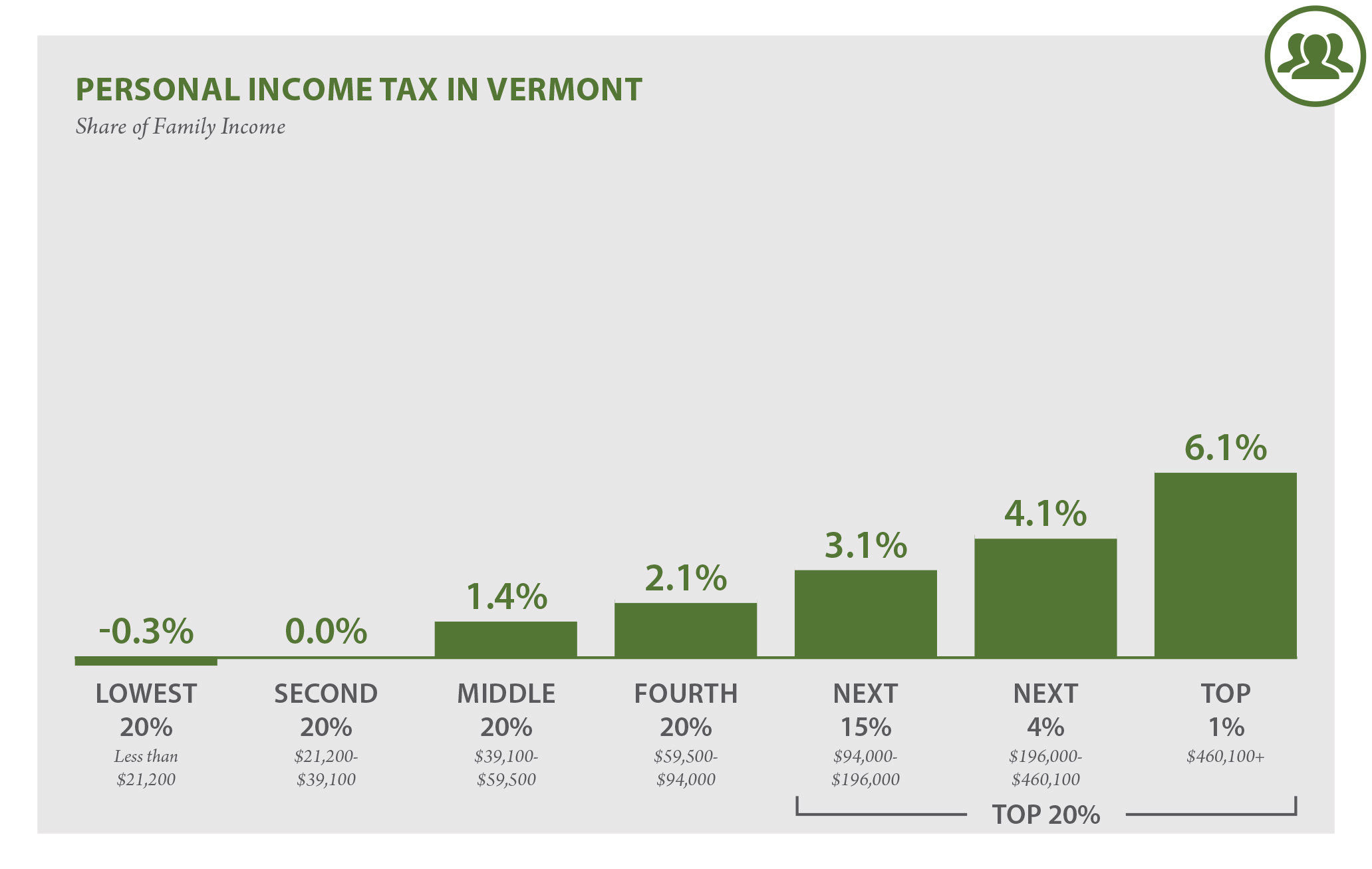

Each marginal rate only applies to earnings within. The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending on your income. Here you can find how your Vermont based income is taxed at different rates within the given tax brackets.

Vermont Income Tax Vt State Tax Calculator Community Tax

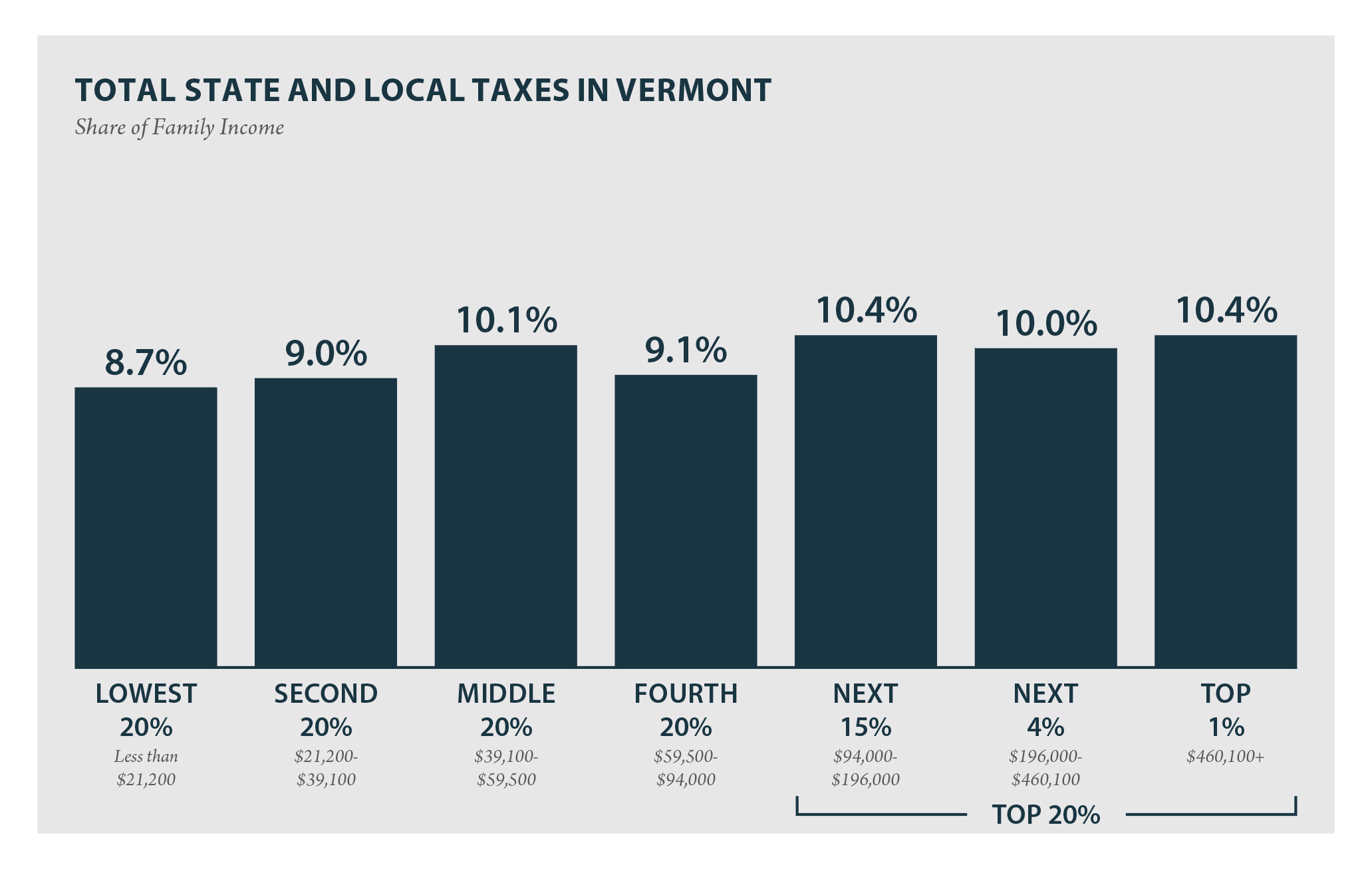

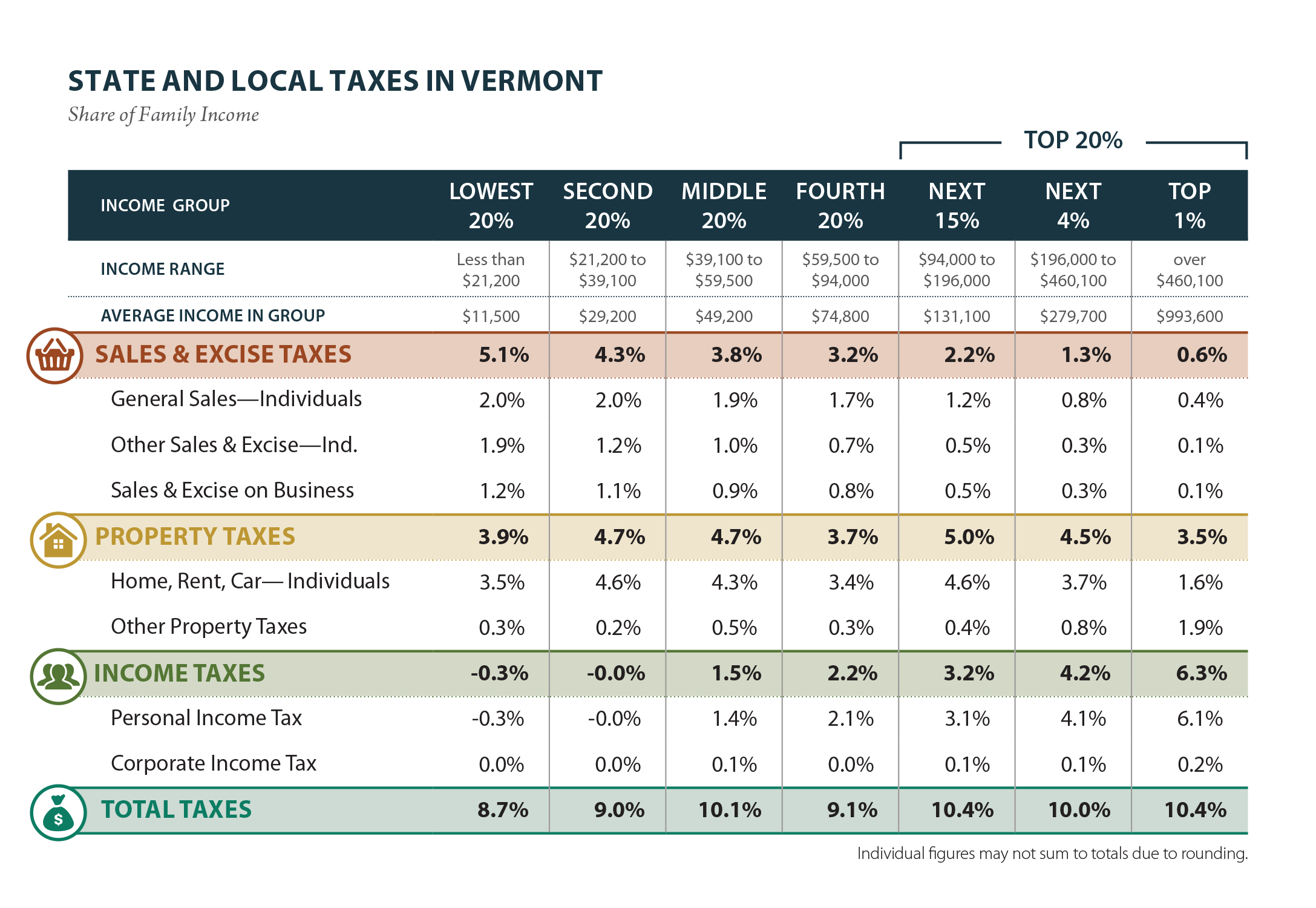

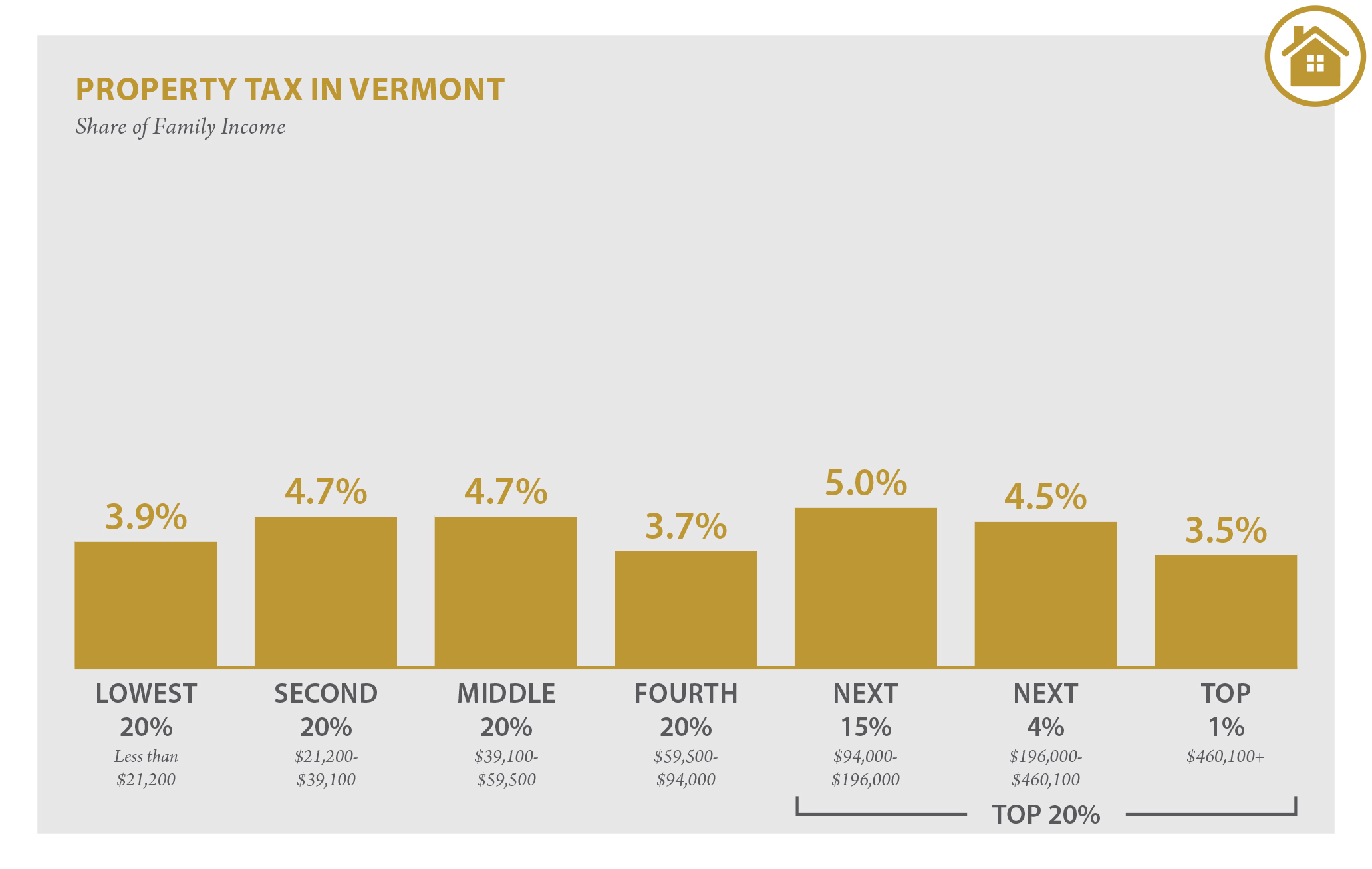

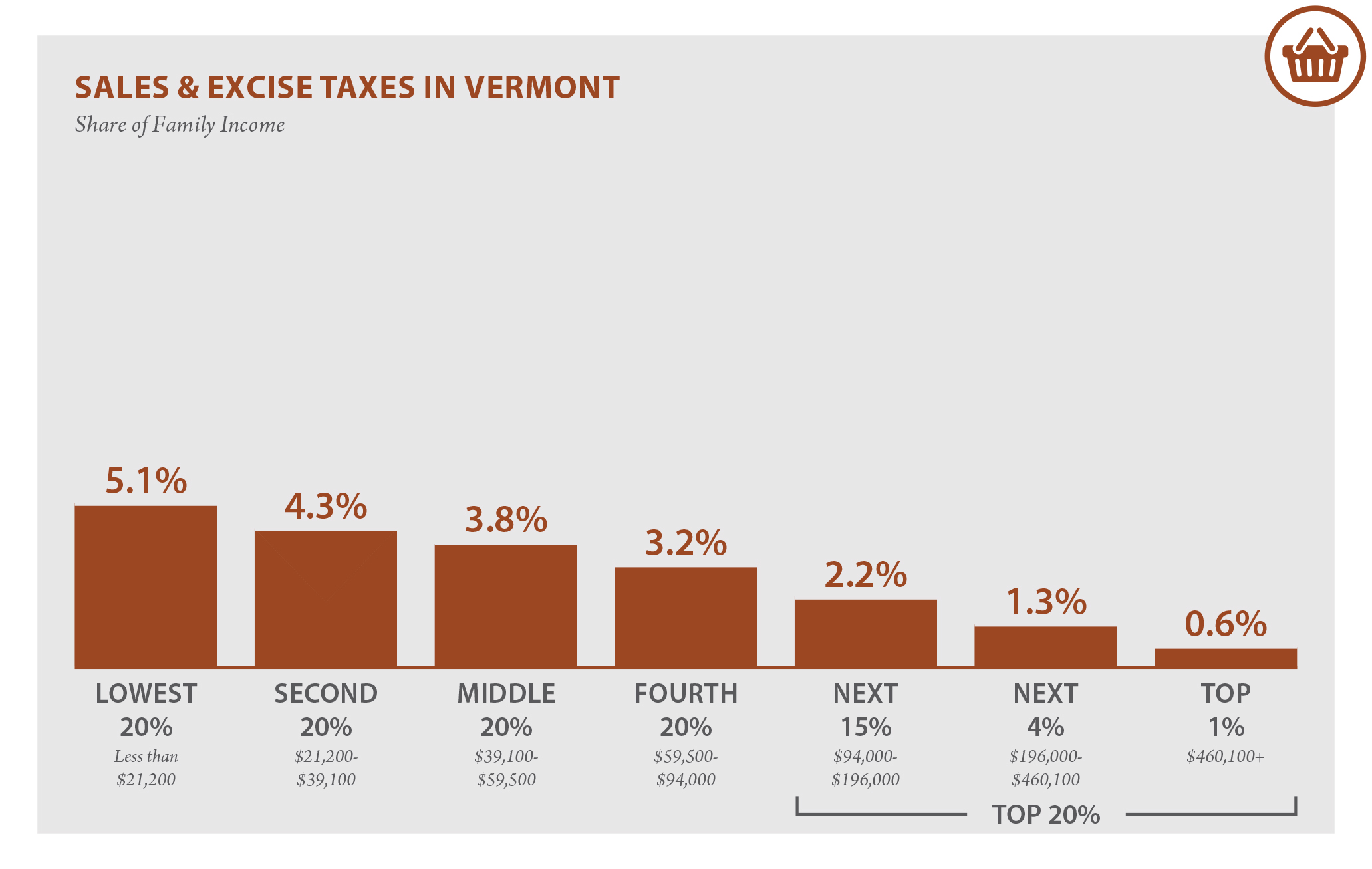

Vermont Who Pays 6th Edition Itep

Vermont Who Pays 6th Edition Itep

Vermont Income Tax Vt State Tax Calculator Community Tax

The Most And Least Tax Friendly Us States

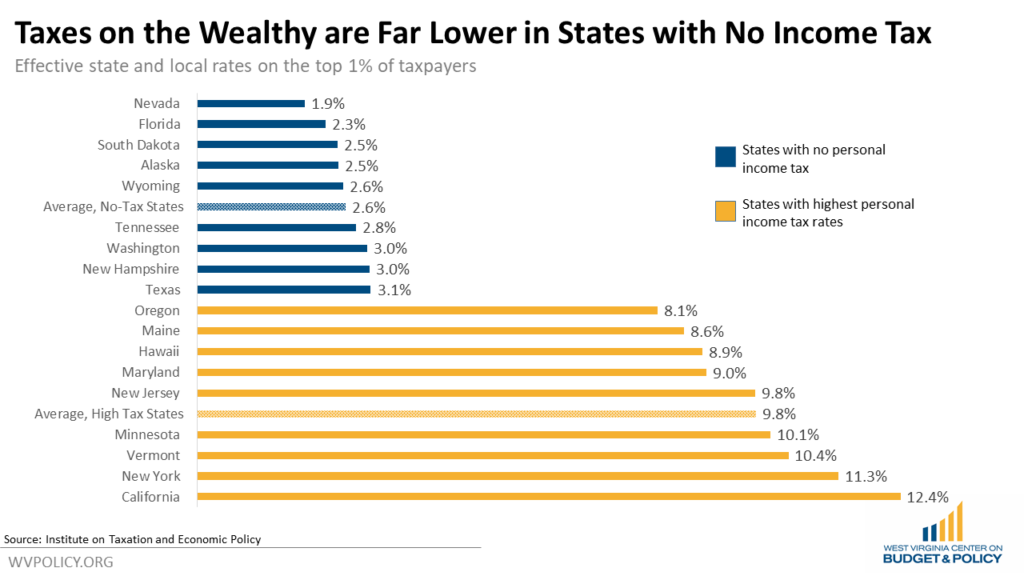

Eliminating The Income Tax Benefits The Wealthy While Undermining Important Public Investments West Virginia Center On Budget Policy

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Who Pays 6th Edition Itep

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

Vermont Who Pays 6th Edition Itep

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Who Pays 6th Edition Itep

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Effective State Income Tax Map Public Assets Institute

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute